Republicans’ legislation will increase prices for Coloradans, strip health care from 17 million Americans, increase the deficit, and give tax cuts to the ultra-wealthy

Republicans blocked Hickenlooper-backed amendments to protect funding for Medicaid and clean energy

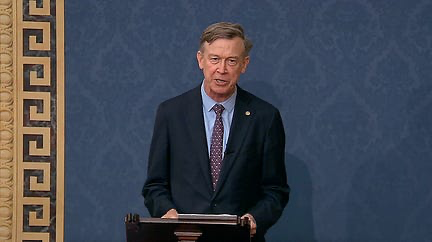

WASHINGTON – Today, U.S. Senator John Hickenlooper released the following statement after he voted against Republicans’ Senate budget bill:

“This is pure lunacy, and downright cruel.

“Republicans have voted to kick 17 million Americans off their health care, push hundreds of rural hospitals toward closure, wipe out millions of American clean energy careers, and add trillions to our national debt. And for what? For lavish tax cuts for the wealthiest Americans.”

Hickenlooper voted NO on the budget resolution after Republicans voted down critical Democratic-led amendments to prevent cuts to Medicaid, SNAP, and Inflation Reduction Act clean energy funding. While Hickenlooper was successful in working with his colleagues to eliminate devastating public lands provisions and alter a few of the worst clean energy proposals, he joined a bipartisan group of senators in opposition to the final bill. The reconciliation bill now heads to the House for final passage. Hickenlooper will continue fighting against it and urge every member of the House to stop it from becoming law.

HICKENLOOPER AMENDMENT:

Hickenlooper spoke on the Senate floor in support of his amendment to protect the Inflation Reduction Act’s residential clean energy credit – which covers 30% of the cost of purchasing and installing residential solar, battery backup, or geothermal heat pumps. Hickenlooper’s amendment would protect the program from Republican cuts for one year, giving clean energy small businesses in Colorado and across the nation a runway (at bare minimum) to weather the storm the Republicans are causing and prepare for the loss of federal funding, in addition to preserving more than 85,000 American jobs. Watch his full remarks about his amendment HERE.

“They’re also taxing clean energy and cutting larger energy credits, which will create more expensive energy and more blackouts,” Hickenlooper said. “We should create jobs, cut costs, and boost energy production, not sacrifice working families so that the richest Americans pay less taxes.”

WHAT’S IN THE BILL:

The Republican-led Senate reconciliation bill includes a $3 trillion tax cut for the wealthiest Americans. It pays for those tax cuts by:

Taking Health Care Away from 17 Million Americans

- The Republican budget proposal calls for extreme Medicaid cuts of more than $900 billion, which would take away people’s health benefits; make it harder for them to see their health care providers; and prevent seniors from getting nursing home care.

- The budget also fails to extend the Affordable Care Act expanded premium tax credits, which expire at the end of 2025.

- The Congressional Budget Office estimates that failure to extend the tax credits would force an additional 5 million Americans off of their health care.

- The latest CBO estimates that the combined cuts to Medicaid and the Affordable Care Act would result in 17 million Americans losing health insurance by 2034, and increase our national debt by $3.3 trillion.

- The cuts would hit rural hospitals the hardest:

- According to initial estimates, more than 338 rural hospitals across the country are at an acute risk of closure as a result of these Medicaid cuts. Including 6 hospitals in Colorado:

- Delta County Memorial Hospital – Delta (CO-03)

- Conejos County Hospital – La Jara (CO-03)

- Grand River Hospital District – Rifle (CO-03)

- Prowers Medical Center – Lamar (CO-04)

- Southwest Memorial Hospital – Cortez (CO-03)

- Arkansas Valley Regional Medical Center – La Junta (CO-03)

- According to initial estimates, more than 338 rural hospitals across the country are at an acute risk of closure as a result of these Medicaid cuts. Including 6 hospitals in Colorado:

Slashing Investments in Clean Energy and Driving up Energy Bills

- The Republican budget bill guts hundreds of billions in Inflation Reduction Act (IRA) clean energy investments, including tax credits for wind and solar. The results: over a million jobs lost, hundreds of billions in lost GDP and lost wages, electricity price inflation, and killing new renewable energy needed to prevent blackouts.

Increasing Our National Debt by Trillions

- Even after gutting over $1 trillion from Medicaid and other services, the Senate reconciliation bill will still increase our national debt by more than $3.3 TRILLION.

- The Senate version of the bill adds $900 billion moreto the national debt than the previous House version of the bill.

Hickenlooper recently took to the Senate floor to slam the bill as “fiscal madness.”

ADDITIONAL AMENDMENTS:

In total, Hickenlooper introduced and joined 16+ amendments to the 2025 Senate reconciliation bill to oppose Republican provisions that would harm Coloradans. Specifically, he introduced and joined amendments to:

Prevent Americans from Losing Health Care

- Protect Nursing Homes and Medicaid Patients: Hickenlooper-led amendment to strike any provision that cuts funding for Medicaid, which covers care for 60% of all nursing home residents.

- Safeguard Small Businesses and Medicaid: Hickenlooper-led amendment to strike any provision that cuts funding for Medicaid and the Affordable Care Act (ACA), which protects access for the 7,000,000 small businesses workers who depend on Medicaid coverage; and protects access for the 4,000,000 small businesses who depend on the ACA exchanges.

- Protect Medicaid: Led by Senator Wyden, Hickenlooper joined this amendment to strike any provision that cuts funding for Medicaid; and would ensure big corporations and the ultra-wealthy pay a fair share in taxes.

- Extend ACA Enhanced Premium Tax Credits: Led by Senator Jon Ossoff, Hickenlooper joined this amendment to permanently extend the Affordable Care Act enhanced Premium Tax Credits.

Protect Safety Net Programs

- Safeguard SNAP-Education: Led by Senator Angela Alsobrooks, Hickenlooper joined this amendment to strike the section that eliminates the SNAP Education Program, which provides free nutrition education to SNAP recipients.

- Expand Pell Grant Eligibility: Led by Senator Tim Kaine, Hickenlooper joined this amendment to strike the workforce Pell section in the budget bill and replace it with the bipartisan JOBS Act to expand Pell Grant eligibility to include short-term workforce training programs.

Protect Public Lands

- Block Sale of Public Lands: Hickenlooper-led amendment to block the sale of our public lands. The amendment ensures that public lands cannot be sold if they hold any of the multiple values our public lands offer, including benefits for watershed health, hunting, fishing, recreation, and critical wildlife habitat. It also excludes sale of lands with cultural or historic significance, areas sensitive for national security, areas within an Indian reservation, or lands to which Tribes hold reserved rights.

- Non-Competitive Leasing: Hickenlooper-led amendment to strike provision that would reauthorize non-competitive leasing on federal public lands.

- Maintaining National Park Service Staffing: Led by Senator Angus King, Hickenlooper joined this amendment to strike the repeal of ~$267M in Inflation Reduction Act funding for the National Park Service staffing.

Address our Climate Crisis + Invest in Renewable Energy

- Protect the solar industry:Hickenlooper-led amendment to change the termination date of the 25D Residential Clean Energy Credit from December 31, 2025 to December 31, 2026 to save jobs and small businesses and help American households power their homes and reduce energy costs with solar, battery storage, and geothermal heat pumps. It is paid for by increasing the top tax bracket to 39.6%.

- RECA Expansion: Hickenlooper-led amendment that adds Colorado to the list of states that benefit from an expanded downwinder provision under the Radiation Exposure Compensation Act.

- Advanced Manufacturing Tax Credit: Led by Senator Michael Bennet, Hickenlooper joined this amendment to strike all changes to the 45X Advanced Manufacturing Tax Credit, but retain foreign entities of concern rules, and strike changes to 48C advanced energy tax credit.

- Maintaining Parity for Wind and Solar Facilities: Led by Senator Jacky Rosen, Hickenlooper joined this amendment to restore parity for solar and wind with other technologies under the Production Tax Credit (45Y) and Investment Tax Credit (48E), paid for with an increase to the top rate at $1 million for individual filers and $1.3M for married filing jointly.

- Eliminating the tax on wind and solar: Led by Senator Adam Schiff, Hickenlooper joined this amendment to strike the new excise tax on wind and solar, paid for with an increase to 39.6 percent for individuals making $10 million.

- Repeal of Termination of Certain Clean Energy Credits: Led by Senators Jean Shaheen and Peter Welch, Hickenlooper joined this amendment to strike provisions that would terminate the Energy Efficient Home Improvement Credit (25C), the Residential Clean Energy Credit (25D), the New Energy Efficient Home Tax Credit (45L), and the Energy Efficient Commercial Building Deduction (179D).

- Maintaining Modernized Royalty Rates: Led by Senator Jacky Rosen, Hickenlooper joined this amendment to strike the repeal of the Inflation Reduction Act royalty rate modernization for oil and gas.

Budget resolutions guide federal spending and revenue policies for the year. This is the third budget resolution the Senate has voted on during the reconciliation process. Hickenlooper voted against the first package in February, and the second package in April. The Senate and the House must pass identical versions of the budget for the reconciliation bill to become law.

###