Hickenlooper: “Their lavish tax bill gives more to the top earners while taking away from the Americans with the least.”

Republicans’ national budget will increase prices for Coloradans, gut critical services, and balloon the national debt to bankroll tax cuts for the ultra-wealthy

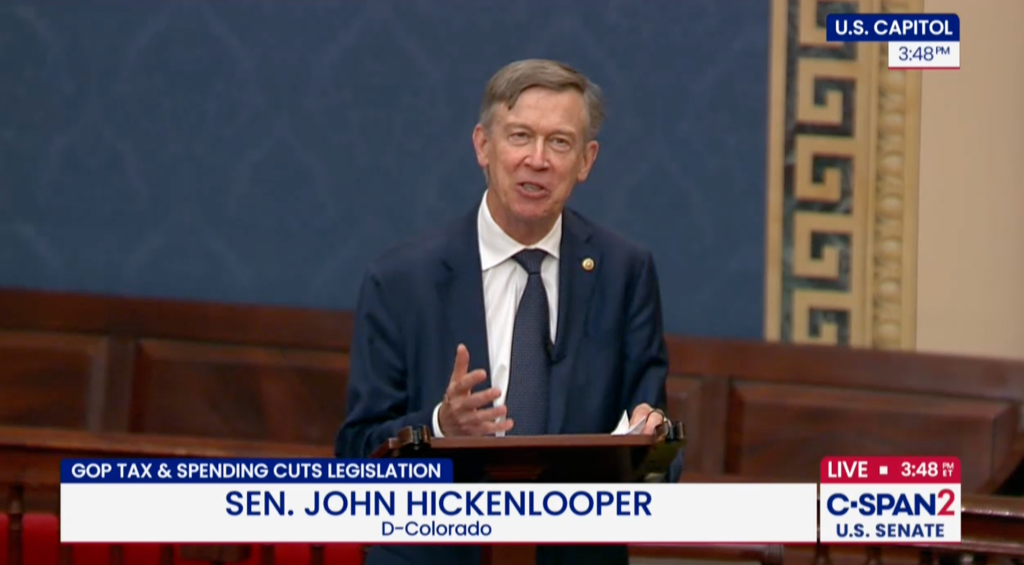

WASHINGTON – Today, U.S. Senator John Hickenlooper spoke on the Senate floor to call out the Republicans’ reckless budget proposal that would kick 16 million families and their children off their health insurance, sell our public lands, and add trillions to the national debt in order to pay for lavish tax breaks for the wealthiest Americans.

“We can’t borrow millions, we can’t borrow billions, we can’t borrow trillions just to hand out tax cuts to the top when working families are struggling to be able to afford everyday goods. It doesn’t add up. It never has. It never will,” Hickenlooper said.

“I’ve managed budgets before – back when I started Colorado’s first brewpub, then as mayor of Denver and as governor of Colorado,” he continued. “… I can definitely say this bill that we’re looking at is the opposite of ‘fiscal responsibility.’ It’s fiscal madness.”

Hickenlooper has voted against their disastrous budget twice on the Senate floor and will vote against it again when the final bill comes to the Senate floor. In April, he led a group of Western senators to introduce an amendment to the budget to protect public lands from being sold to pay for Republicans’ tax cuts for the ultra-wealthy and introduced other amendments to prevent cuts to Medicaid and clean energy tax credits.

Hickenlooper is focused on building public pressure against the Republicans’ extreme proposal and recently called out their latest effort to sell off three million acres of public lands to bankroll the Republicans’ lavish tax cuts.

To download a full video of Hickenlooper’s speech, click HERE. A full transcript of his remarks is available below.

“Mr. President,

“This month, my fellow colleagues in the Senate, the Republican Senate members, are working to pass a budget proposal that I feel can best be described as dangerous.

“Their plans are going to dramatically reduce – even gut – services like Medicaid and SNAP, getting food to hungry, low-income workers. It will strip health care away from most likely more than 16 million Americans and threaten millions of seniors living in nursing homes. All this is focused really on just trying to get larger tax breaks to very wealthy people who don’t really – in most cases – don’t really want them, or the largest corporations.

“This lavish, and I think lavish is the only word that describes it fairly, this lavish tax bill gives more to the top earners while taking away from the Americans with the least.

“But, it really doesn’t have to be that way. If the Republicans could focus on extending tax cuts for working families, rather than the wealthiest, they could – in and of that one effort, that one initiative – they could avoid ripping away health care from more than 15 or 16 million Americans and gutting our much needed investments in fighting climate change and to make sure that we have lower energy prices.

“Instead, they’re going full steam ahead with really what is a god-awful bill.

“I want to focus today on another dangerous part of this plan: how it explodes our national debt and really risks our economic future.

“Many proponents of the bill love to hem and haw about being financially responsible.

“But, like a few people in here, I’ve managed budgets before – back when I started Colorado’s first brewpub, then as mayor of Denver and as governor of Colorado. So, I know something about fiscal responsibility – and it’s not partisan. At its best, fiscal responsibility should be bipartisan.

“I can definitely say this bill that we’re looking at is the opposite of ‘fiscal responsibility.’

“It’s fiscal madness.

“This is a massive spending bill that’s going to create the largest national debt in American history.

“And you don’t have to take words for it: you can look at the numbers.

“The nonpartisan Congressional Budget Office estimates that the House Republican plan, so this is the plan coming over from the House, would add $2.7 trillion – that’s trillion with a T – $2.7 trillion dollars to the deficit over the next decade.

“The Penn Wharton Model, which includes something like North of $500 billion dollars in the additional interest payment from that accumulated debt over year, after year, after year – over those 10 years – suggests it would add up not just to $2.7 trillion but more like $3.2 or $3.3 trillion over ten years.

“The bill our Senate colleagues are putting together makes many of the same mistakes. And I think by most measures that a small business person would look at, it’s reckless.

“Bottom line is more American tax dollars would go towards tax cuts for again, at least in Colorado, the people I’ve talked to aren’t asking for, aren’t seeking, these tax cuts.

“And they, you know under this tax plan that came over – is coming over to us right now – those tax cuts for the very wealthy are coming instead of expanding access to health care, or building roads, or improving our schools.

“And more tax dollars would go to paying off the massive debt – paying the interest on the massive debt – than all of our defense spending combined. It will become more than 25% of our federal budget, just to pay interest on the debt.

“Now, if that sounds like a bad idea to you, it’s because it is – and the markets agree.

“Moody’s, the last major credit rating agency to maintain the US at its highest-level rating – designated a safe place to invest your money – just downgraded our credit rating.

“It’s the first time that’s happened, and it shook investors that Moody would downgrade our credit rating.

“Investors aren’t confident that the U.S. will be able to pay its debts. And that’s, at least in terms of Moody’s, has never happened before. And it’s really just going to lead to more trouble.

“Those investors who buy those ten-year bonds and help pay for our national debt, are demanding higher returns because they view it as a riskier investment. They need a higher return if they’re going to hold U.S. debt, which forces – since you’ve got to attract that investment, it means you’ve got to offer higher interest rates which means you’ve got higher borrowing costs.

“And that means that Coloradans, and Americans, are going to pay higher interest rates when they want to buy a house, or expand their business, or if they want to pay off their credit cards.

“They’re going to have to pay more because the interest rates are going to be higher.

“Now, Americans are already plenty concerned about rising prices, for good reason. This whole system could lead to the dreaded ‘stagflation’.

“This could all become a one-two punch to working families – all the while the wealthiest families end up being better off.

“We don’t need to do this. We can certainly grow our economy, we can help working families, and we can cut the deficit.

“We were able to balance the budget all eight years I was mayor of Denver, all eight years I was governor, and still grow our investments in our roads, in our education system, in our health care system.

“We also did this with the Inflation Reduction Act, which would reduce the deficit by over $175 billion over the next ten years and has already dramatically lowered a number of prescription drug costs, it has expanded health care access, and, in the process, created hundreds of thousands of good jobs.

“The Republican budget, I think, does the opposite.

“We also can’t forget that this budget comes in the midst of the Trump administration’s efforts around tariffs.

“What our good friend, the senator from Washington, was just talking about when she described the consequences of Smoot-Hawley. And how those tariffs – just at 20% – led to a global slowdown in the overall economy.

“We all know that these tariff-taxes are really not so hidden taxes on the American people. They raise prices on everything from groceries to kitchen appliances.

“Now none of this is a growth strategy. It really is a recipe for recession at the best, stagflation at the worst.

“We can’t borrow millions, we can’t borrow billions, we can’t borrow trillions just to hand out tax cuts to the top when working families are struggling to be able to afford everyday goods.

“It doesn’t add up. It never has. It never will.

“Now there are issues that may be partisan, but being financially responsible doesn’t need to be one of them. Neither should good, strong economies. Neither should economic fairness. Neither should protecting working families.

“They really don’t have to do it this way.

“Now, I’m always game to roll up my sleeves and dig into the balance sheet, but we haven’t seen from the other side that they’re willing to negotiate – or really invest in the long-term economic growth.

“I’d suggest that we write a budget that reflects our values and puts tax cuts toward working families first.

“A budget that strengthens the middle class. One that keeps our economy strong and will keep it growing for generations to come.

“This bill is not any of that.

“I urge my Republican colleagues – in the House and the Senate – not to temporarily put a pass on their values and to support this, again I think truly reckless fiscal bill.

“I hope that we can come together and negotiate a better bill that does more economic growth and puts a far, far lesser penalty on the working people of America.

“Thank you, Mr. President. I yield the floor.”

###